Understanding the basic requirements for certified payroll

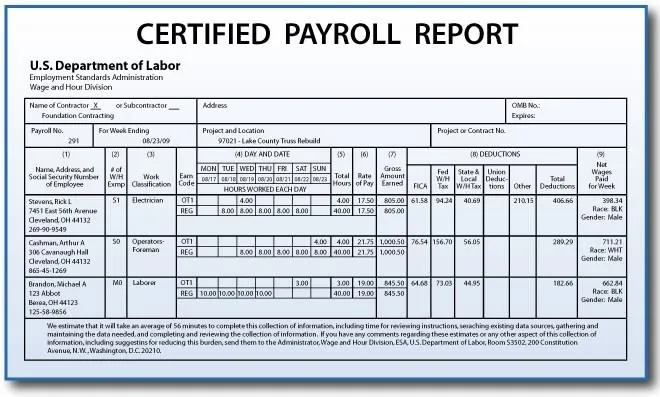

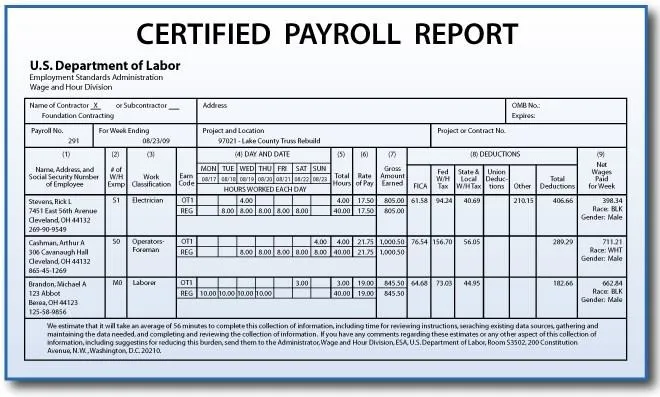

Certified payroll reports, which need to be submitted every week to the agency that oversees a certain government contract, list every employee who performed work on a job. Understanding the guidelines and using reliable software for certified payroll reporting is beneficial, as the report must share information, like the hours employees worked each day, the wages they were paid, the type of work they performed, and the benefits they received. It also contains a statement of compliance.

View a list ofreport samples.

nbsp;3:33

nbsp;3:33

What are the requirements beyond 2022?

2022 has been a good year for certified jobs and there are no signs of slowing down. This is, in part, because bipartisan legislation called the Infrastructure Investment and Jobs Act was passed in late 2021 and signed into law, with the federal government investing more than $500 billion in new spending on a variety of infrastructure upgrades and projects across the country.

How does a payroll report get certified?

A payroll is eligible to be declared certified when it includes a signed statement of compliance indicating that the payroll report is complete and correct. It needs to declare that each employee has been paid a wage greater than or equal to the Davis-Bacon prevailing wage.

If the company owner or head of payroll signs a statement of compliance, any fabrication or falsification discovered upon investigation can lead to civil or criminal prosecution of the contractor or subcontractor. This is why it’s critical to understand certified payroll reporting guidelines and have software that generates accurate reports and is simple to use.

What are some common mistakes to avoid?

Development and submission of a certified payroll report can be a challenge for contractors working on government-funded projects, especially if they lack expertise. Below we are going to highlight some of the common mistakes which need to be avoided.

- Many contractors are under the misconception that they need to be a Certified Payroll Professional (CPP) and pass a certain exam in order to create and submit a certified payroll report. This is completely untrue. Anyone who meets the American Payroll Association’s criteria can become a CPP. It is very difficult to become a CPP, but any payroll person can complete and submit a certified payroll report.

- Most contractors presume that all 50 states follow the same payroll reporting format. This is not true. States have multiple and varying requirements for certified payroll report formats as well as electronic form filing.

- Many contractors think that their payroll software tool will automatically generate certified payroll reports. This is not recommended at all. Anyone who needs to file a certified payroll shouldn't rely on a single software tool. Rather, they should be aware of their particular state's regulations regarding certified payroll. This could require more detailed filing and reporting techniques.

Who should create a certified payroll report?

Creating and submitting acertified payroll report can be done by anyone, assuming they have the tools and expertise to do so. Whoever handles your certified payroll reporting will need to be able to answer the following questions:

- Which employees worked on the certified project?

- Which trade or work classification was the work performed as?

- How many hours did each employee work each day?

- How much was each employee paid?

- What were the gross wages for the week?

- What was deducted from each employee’s paycheck? (Taxes, union dues, child support, etc.)

- What was the net amount each employee earned for the pay period?