Payroll services are very important, and managing an organization’s payroll is no easy task — it’s time-consuming and complex. Many companies have an accountant on staff to handle the full-time job of managing payroll services, with a lot of their time spent on administrative tasks and records. But what about contractors or companies that are required to take the extra step of filling out certified payroll reports weekly to be compliant with government entities while also having to outsource their payroll needs?

With Certified Payroll Reporting , powered by Points North, you can use a simple software solution that pairs with your existing payroll software of choice, helping you meet your certified payroll reporting needs so that you can be compliant and avoid government-imposed penalties. This is key since all your employee details need to be accurately recorded to ensure they are being paid a prevailing wage that meets your contractual obligations.

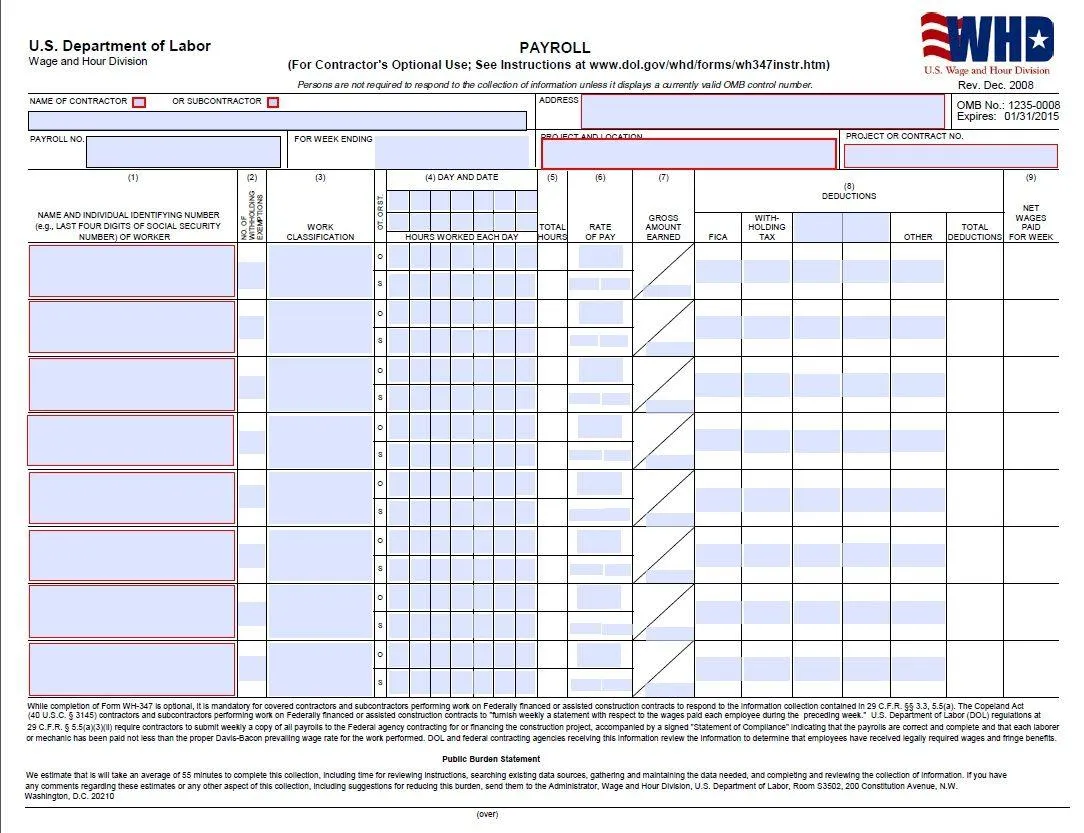

Whether you use software or want to fill out your reports manually, it’s good to get familiar with the form and reporting process. Below you will see a sample WH-347 form.Continue reading to learn how to fill out certified payroll reports.

Instructions for Completing the Certified Payroll Report Form WH-347

Detailed instructions for filling out the certified payroll report are given below, with screenshots provided.

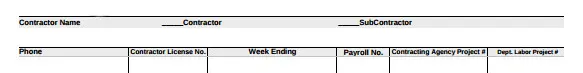

- For contractor and subcontractor:Fill in the company and firm name.

- For address:Provide the address of the firm or company where the company is located.

- For payroll number:Start with the number “1”, then list the number for the submission of the payroll.

- For the week ending:Write down the last date of the workweek.

- Project, location, and contract number:Self-explanatory.

- Name and inpidual identify name or worker:Write down the name of the inpidual or worker, and also their identifying number, which consists of the last 4 digits of the employees’ security number.

- The number of withholding exemption:This column is filled based on employee preference, but it is not mandatory to fill this column and it’s not essential to fulfilling the requirements of the checking authority.

- Work classification:Write down the type of work performed by each employee within the organization.

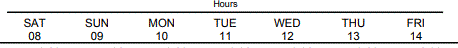

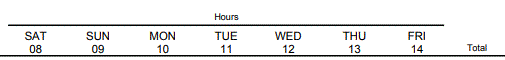

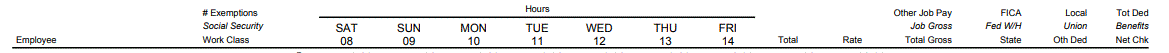

- Hours worked:Write down the date, time and overtime worked in the form box. If the work hours exceed 40 hours in the week, the additional hours are considered overtime.

- Total hours:Write down the total hours in which the employee worked for the whole week.

- Rate of the pay:Write down the rate that the organization pays to its employees. If the company pays per hour, then note that. If the company pays per day, document that information. Or, if the company pays by week, add that information accordingly. Also, write down the overtime rate that the company gives to the employees. If the company gives a bonus or another type of benefit, also include that information on the form.

- Gross amount earned: Write down the earned gross amount that is earned on the project.

- Deductions:Write down the entire deducted amount that the company deducts in the form of taxes or fines.

- Net wages paid for the weeks: Self-explanatory.

Certified payroll reports need to include all the government-required information related to employees, their pay, and their statement of compliance in order to be compliant while working on publicly funded projects. The certified payroll report consists of two pages, with a company official signing off on the second page. This signature is the certification that represents the information on the report is accurate and correct. Certified Payroll Reporting simplifies this process for contractors and organizations, making it fast to follow instructions and be compliant.

A large number of people and their organizations rely on Certified Payroll Reporting, which helps them to save time and money — regardless of which local, state or federal entities they need to file with.

Get Started with Certified Payroll Reporting

Now that you have a basic understanding of how to fill out certified payroll reports, you get the idea of how difficult compliance can be without some third-party help — especially if you don’t have a full-time accountant on staff. For a simple automated solution, Certified Payroll Reporting takes away the heavy lifting of manually completing any certified payroll report.

Certified Payroll Reporting can provide you with automated generation of any prevailing wage report for local, state or federal entities you have to file with. This software solution can also provide you with the ability to generate and store reports within minutes. With its user-friendly interface, you can create and submit reports related to your public work projects, saving you time while helping you with compliance.

Thousands of contractors throughout the country rely on Certified Payroll Reporting to simplify their prevailing wage reporting. Contact us to join them.