If you work with contractors then you have to take care of loads of paperwork at the end of every fiscal year which includes the 1099-MISC forms. You will be sending this form to your contractors for the work they have done throughout the year in question.

Payroll Solutions for Contractors

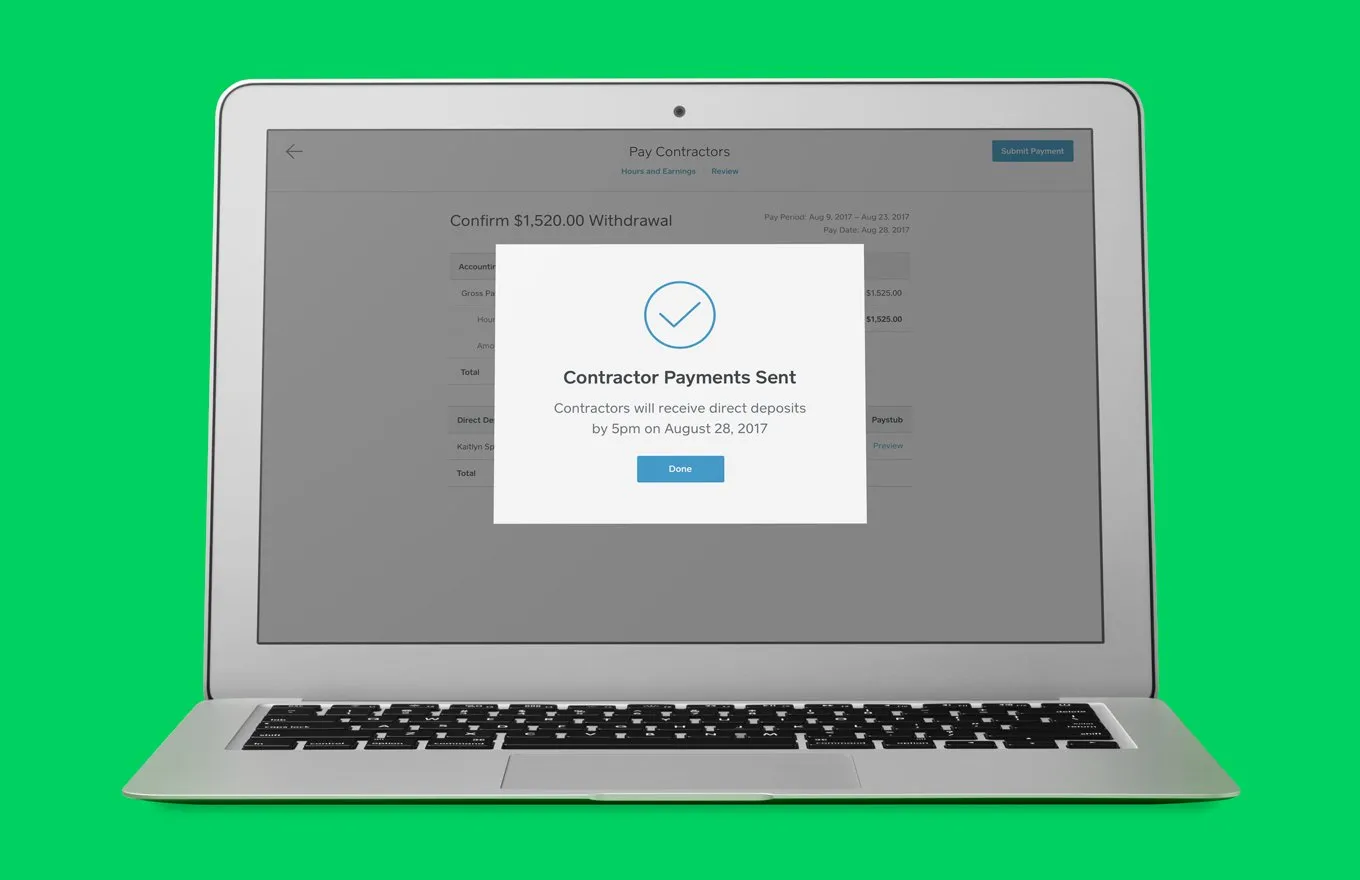

Hence, you need to maintain records of all the payment details made to you or by you. This information is needed for filling out the 1099-MISC forms. If you work with a lot of contractors then you will be spending a lot of manhours at the end of every fiscal year in figuring out who needs to fill out a 1099-MISC form. However, you won’t have to go through all this only if you allow technology to make your job easier. There are many software's available to allow you to manage your employees and your contractors in the same place.

1. QuickBooks Payroll

It offers a payroll option which can be purchased on its own or paired with its accounting software. QuickBooks offers two variants of payroll, which allows you to do choose between manual control or QuickBooks automating everything. You can then file the 1099s by using the built-in e-file services. The pricing for this depends on the number of 1099s you are filing and the product you are using.

2. Paycor Perform

It is a cloud-based payroll system which can manage your entire payroll workflow. It can manage payments, tax preparation, tax filing, and payroll admin. This system can be accessed via multiple devices hence it allows you to manage whatever you need and wherever you need.

3. Patriot Payroll

It is a standalone product which falls outside of its online payroll services. It can help you in managing your contractors and forms related to them. Hence, it keeps everything separate from employees on your payroll. It keeps track of payments, reports on those payments, and printing the original payments in the check form. It allows you to process additional payments for royalties, rents, and attorneys as well.

4. Xero

It allows you to enter every contractor in your system. It will allow you to then set up rules for ensuring that every payment made by you is categorized in a correct manner. It will then automatically transfer payment data but it will skip over things which are not included by the IRS in calculating the limit of $600.

.png)